Redelegate & Switch Validators

We will recap what we shared in Part 1 and today in Part 2, we will share concrete examples that show why it’s important to stake your tokens with smaller validators….

…and why we’re offering you monthly ATOM airdrops to do so. Connect Keplr or Cosmostation desktop to our Mintscan page to redelegate or stake ATOM with us.

The simplest way to stake ATOM with Atlas is from our promo dashboard.

We also have detailed staking tutorials for Cosmostation, Leap, Keplr and Ledger Live.

COSMOS AIRDROPS

New projects and protocols give away tokens to attract users. Crypto rewards those who participate, so register today and collect your free crypto.

You’ll receive PROJECT DETAILS, TOKEN SYMBOL, SNAPSHOT DATES, ELIGIBILITY REQUIREMENTS, LINKS TO CLAIM AND LINKS TO STAKE.

Be sure to add info@atlasstaking.com to your contacts, so our email doesn’t go into your spam folder. You don’t want to miss out!

We will NEVER share or abuse your information

How Validators Make Money

Remember from Part 1 that validators make money in 3 main ways:

1) Proposing/originating a block of transactions

2) Verifying the accuracy of a previously proposed block and signing off on it

3) Charging commission

Validators compete with each other to verify on-chain transactions first and propose a block. This is where the real money is made.

The validator that originated the block earns most of the rewards. The other 179 validators split the remaining rewards.

Remember From Part 1?

The number of tokens staked with a validator determines their ability to propose and originate blocks. It’s called, “voting power.” When you stake tokens with a validator you are providing them with voting power.

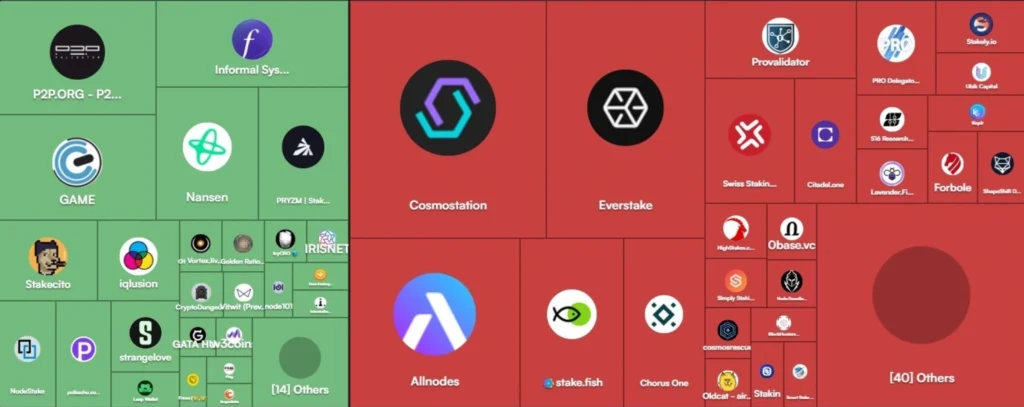

You’ll recall the largest validators with the most tokens propose and originate most of the blocks and thus collect most of the rewards.

Here are a few specific examples. None of what we’re about to show you is meant as a personal attack against these validators. We envy them, actually.

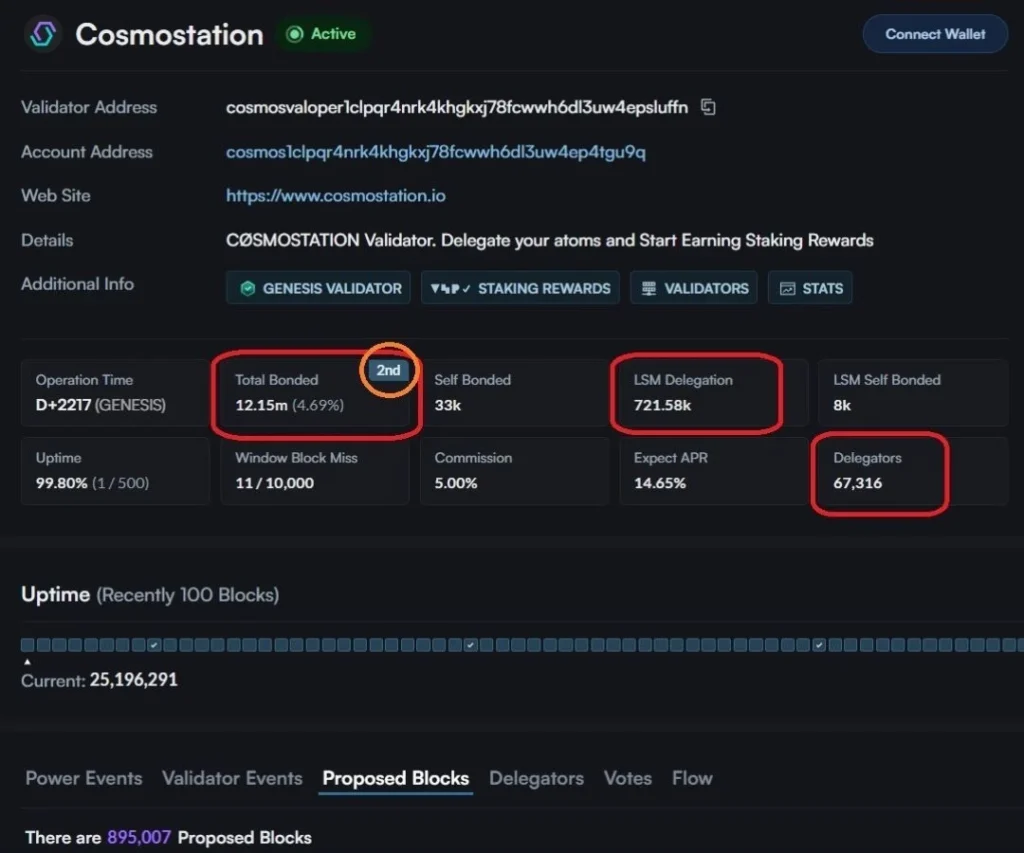

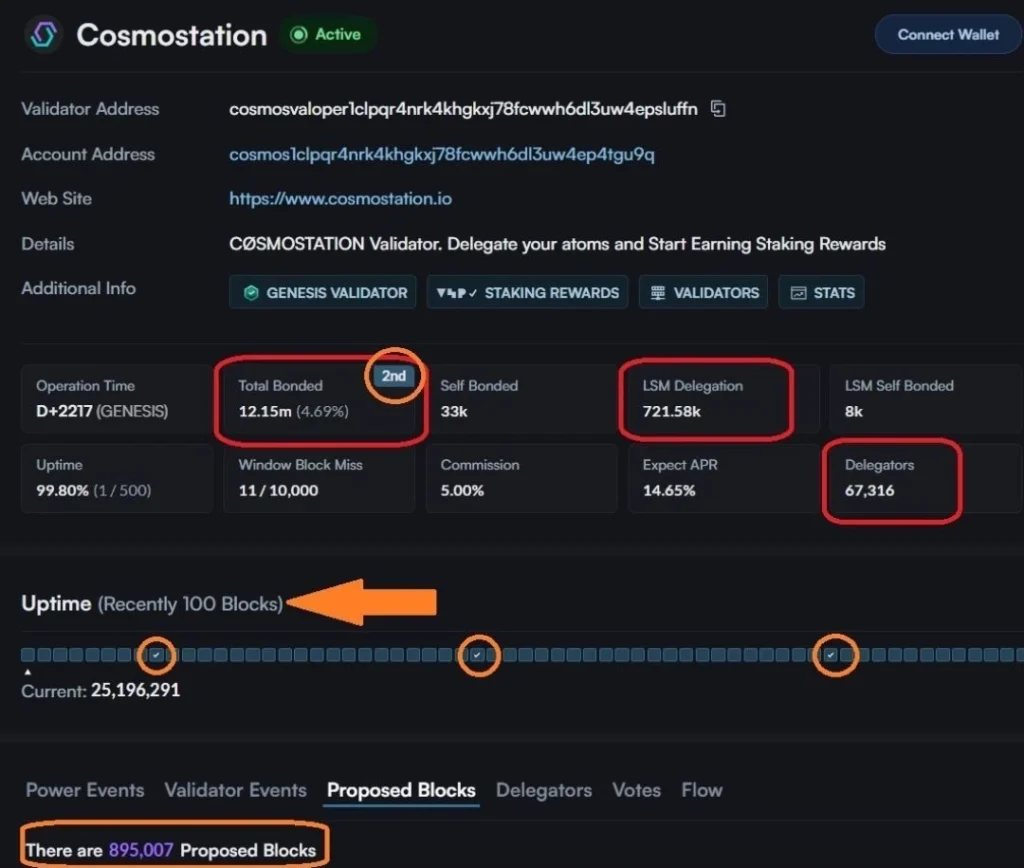

Below you will see that Cosmostation is the 2nd largest validator, with over 67,000 delegators staking 12.15 million ATOM tokens. They also receive 721k ATOM tokens from Stride.

Now, in the screenshot below you’ll see that Cosmostation has proposed 895,007 blocks, which is just shy of 5% of all blocks. The circled checkmarks are blocks they proposed and the revenue is substantial.

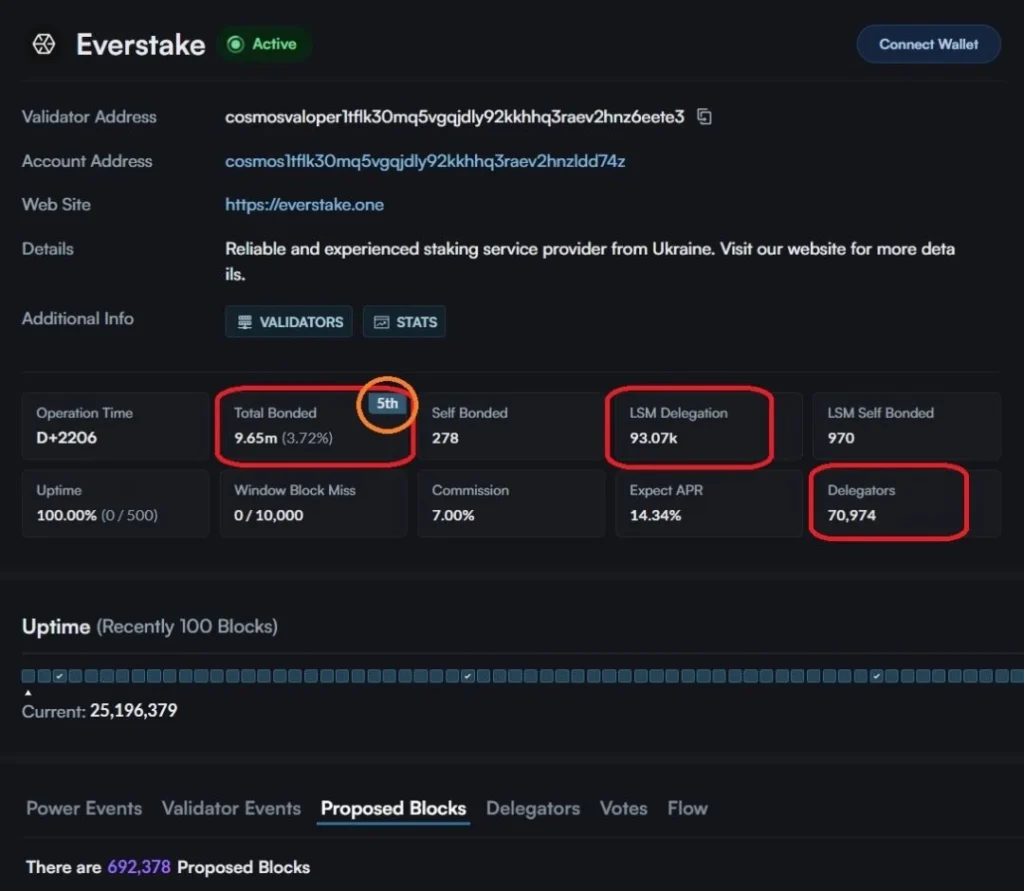

Next we’ll check out Everstake, the 5th largest validator with almost 71,000 delegators staking 9.65 million ATOM tokens. They also receive 93k ATOM tokens from Stride.

Now in the next screenshot you’ll see that Everstake has proposed 692,378 blocks, which is around 4% of all blocks. Remember, the circled checkmarks are proposed blocks.

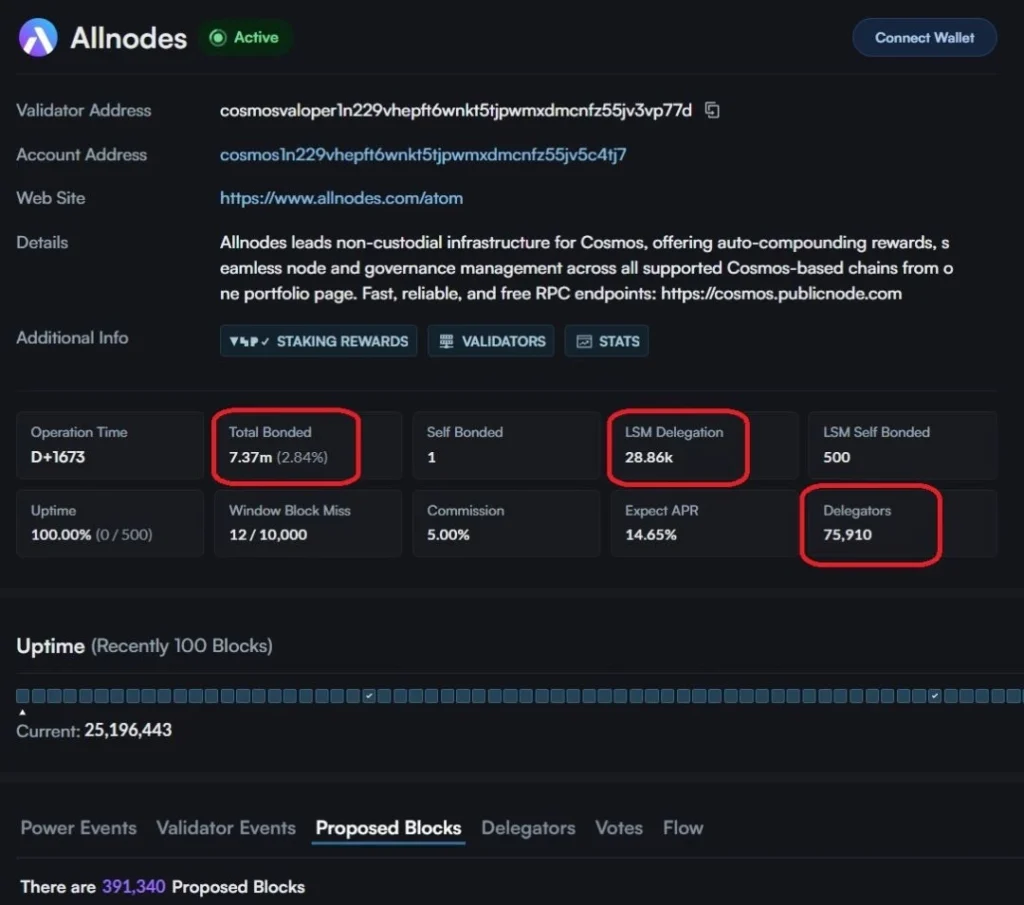

Lastly for the big guys, let’s take a look at Allnodes. They are the 9th largest validator with almost 76,000 delegators staking 7.37 million ATOM tokens. They also receive 28.8k ATOM from Stride.

Now you’ll see in the screenshot below that Allnodes has proposed 391,340 blocks, which is just over 3% of all blocks.

NOW LET’S TAKE AN EXAMPLE FROM THE BOTTOM OF THE ACTIVE SET

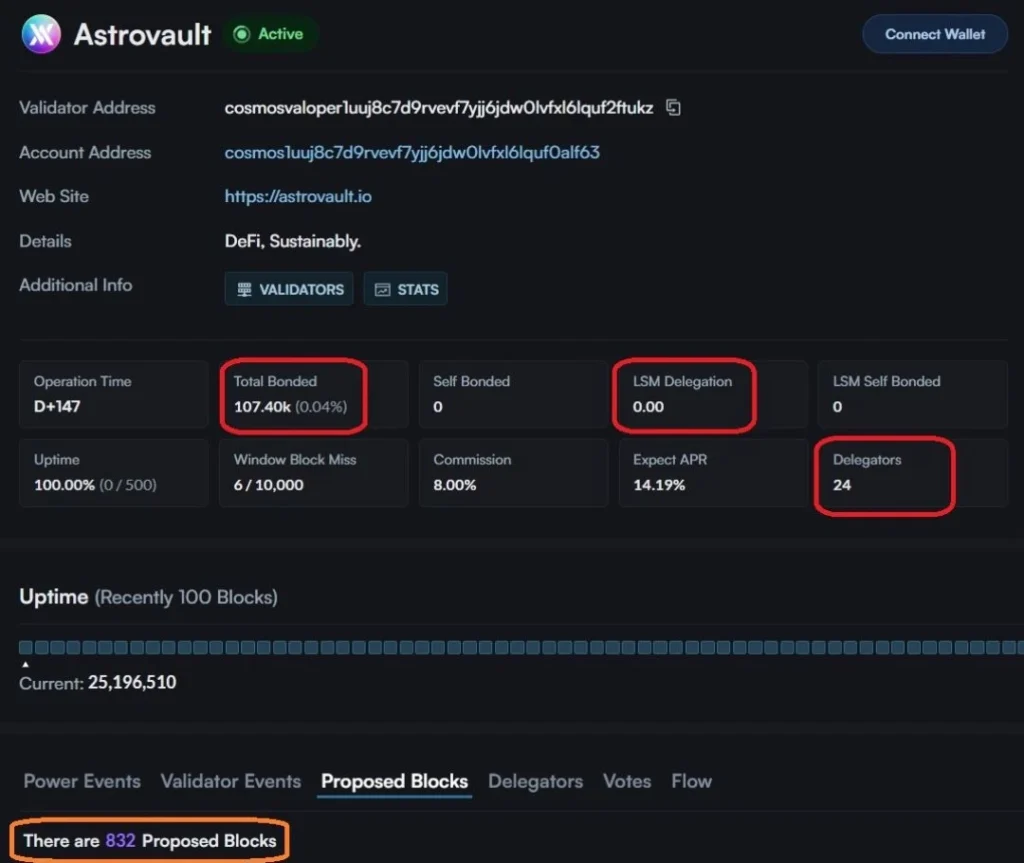

Below you’ll see Astrovault, ranked 176th with 24 delegators staking 107k ATOM tokens. They receive 0 ATOM from Stride. You will also see they have only proposed/originated 832 blocks, which is 0.04% of all blocks.

Quick Review

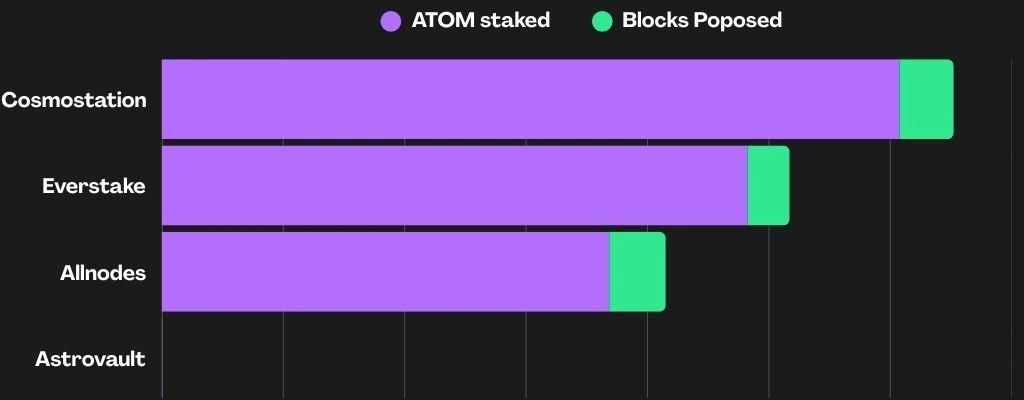

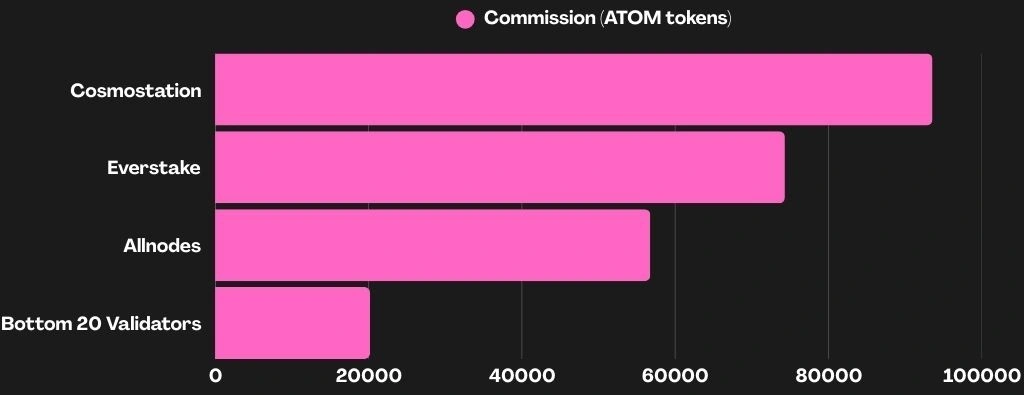

Do you see the enormous discrepancy? Astrovault doesn’t even register on the chart below.

Now, instead of Astrovault you’ll see the bottom 20 validators combined and compared to Cosmostation, Everstake and Allnodes.

The bottom 20 validators combined don’t even propose as many blocks as Everstake!

Remember From Part 1?

The validator that proposed and originated the block does not share that profit with delegators. You are paid the current staking APY minus your validator’s commission, no matter how many blocks your validator originates.

Therefore, you gain no financial advantage by staking with the largest validators.

Just For Fun

Let’s do some quick ‘back of the napkin’ math to see what kind of commission is being earned. We will use the Hub mandatory minimum of 5% commission and current APY of 15.4%.

Cosmostation earns 93,555 ATOM or $395,737 per year in commission. (Envious!)

Everstake earns 74,305 ATOM or $314,310 per year in commission.

Allnodes earns 56,749 ATOM or $240,048 per year in commission.

The bottom 20 validators combined earn 20,201 or $85,450 per year in commission. That’s an average of 4270 ATOM or $18,072 each. Believe it or not, that may not be enough to cover their costs.

As a result of originating most of the blocks and earning the most in commission, the largest validators continue to grow substantially faster than the smaller validators.

There is an ever-widening voting power gap between the largest and the smallest validators.

Therefore, staking with the largest validators centralizes the ecosystem into the hands of a few powerful entities.

Do you see why this could be an issue? That’s terrible for network security.

Let’s look at another example…

Remember From Part 1?

Voting power not only dictates how many blocks a validator might propose and originate, but gives them governance power too.

Think of one staked token as one vote on a governance proposal. A validator with 12 million staked ATOM has 12 million votes, while a validator with 100,000 staked ATOM has 100,000 votes.

Below are the results from proposal 868, which aimed to set ATOM inflation at 0%.

You will see that the majority of community wallets voted YES, but Cosmostation, Everstake and Allnodes voted NO so the prop failed.

We are not arguing for or against the proposal, but think it’s important to show that the community lost the vote to the largest validators.

Therefore, the largest validators control governance and the evolution of the ecosystem, for better or worse.

Part 2 Review

Staking gives your validator voting power. The more tokens staked with a validator, the more voting power they have.

Voting power determines a validator’s influence over governance and the evolution of the ecosystem. Voting power also determines how likely your validator is to propose and originate a block.

Validators collect substantially more rewards for proposing blocks vs simply signing off on a block.

Your validator does not share the profits from proposing blocks with you. Therefore, staking with the largest validators gives you no financial advantage.

The largest validators collect the majority of rewards by proposing the most blocks. They also collect the most in commission.

There is an ever-widening gap between the largest and the smallest validators.

Therefore, the wealth is skewed toward the top and power gets more and more centralized into the hands of a few. And I didn’t even mention the very large and dishonest validator who we caught stealing from delegators.

This is WHY we feel it’s so important to get into the ATOM active set.

How You Can Help

On all blockchains we encourage people to stake in the lower half, or even bottom third of the active set. This spreads out voting power and helps to decentralize and strengthen the network.

Here’s a simple way you can help…

…Stake ATOM with us and 1 other validator, who is in the lower 1/3 of the active set. If you happen to be redelegating away from a top 25 validator, you’re making a difference immediately.

Redelegating to a validator in the lower 1/3 and to us allows you to earn rewards on some of your stake, gives you a chance to win one of our ATOM airdrop NFTs, and helps to decentralize the Hub. Everybody wins.

We’ve tried to make the process as simple as possible by providing tutorials for Leap, Cosmostation, Keplr and Ledger Live.

Once you stake ATOM with us, track your points on our Launchpad dashboard.

Frequently Asked Questions

What happens to my staking rewards when I switch validators?

If you redelegate instead of unbonding, you will not miss out on any staking rewards. However, inactive validators don’t earn rewards. That’s why we are offering monthly ATOM airdrops until 2030 for those who help us get into the active Cosmos Hub set of validators.

How do you define staking?

We would say that crypto staking is the act of locking up or bonding your tokens to support the network. You “delegate” your tokens to a validator and once bonded they are “staked.” Delegators, like you are paid an incentive for locking up their tokens and supporting the network. The incentive is called, “staking rewards.” Staking reward APY varies from moment to moment based on inflation, on-chain transaction fees, validator performance, validator commission, etc.

How do I switch validators?

In your crypto wallet, click into the staking section and generally the options are stake, unstake, and redelegate. Redelegating is the act of switching validators and the transaction only takes a second to go through. On Cosmos chains you can only redelegate and switch validators once every three weeks.

Nothing we say is financial advice or a recommendation to buy or sell anything. Cryptocurrency is a highly speculative asset class. Staking crypto tokens carries additional risks, including but not limited to smart-contract exploitation, poor validator performance or slashing, token price volatility, loss or theft, lockup periods, and illiquidity. Past performance is not indicative of future results. Never invest more than you can afford to lose. Additionally, the information contained in our articles, social media posts, emails, and on our website is not intended as, and shall not be understood or construed as financial advice. We are not attorneys, accountants, or financial advisors, nor are we holding ourselves out to be. The information contained in our articles, social media posts, emails, and on our website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in our articles, social media posts, emails, and the resources on our website are accurate and provide valuable information. Regardless of anything to the contrary, nothing available in our articles, social media posts, website, or emails should be understood as a recommendation to buy or sell anything and make any investment or financial decisions without consulting with a financial professional to address your particular situation. Atlas Staking expressly recommends that you seek advice from a professional. Neither Atlas Staking nor any of its employees or owners shall be held liable or responsible for any errors or omissions in our articles, in our social media posts, in our emails, or on our website, or for any damage or financial losses you may suffer. The decisions you make belong to you and you only, so always Do Your Own Research.